Overtime Calculation Malaysia Employment Act

Your Step By Step Correct Guide To Calculating Overtime Pay. Overtime calculator refers to calculation of any hours worked by an employee that exceed their normally scheduled working hours in Payroll Software Malaysia.

Salary Calculation Dna Hr Capital Sdn Bhd

Basic pay 26 days X 30 X hour of works.

Overtime calculation malaysia employment act. 2 Any employer who fails to pay to any of his employees any overtime wages as provided under this Act or any subsidiary legislation made thereunder commits an offence and shall also on conviction be ordered by the court before which he is convicted to pay to the employee concerned the overtime wages due and the amount of overtime wages so ordered by the court to be paid shall be recoverable as if it. Your Step By Step Correct Guide To Calculating Overtime Pay. Overtime pay is calculated as follows.

However if the breakdown of his wages reflects a basic salary of RM1300 a travelling allowance of RM150 service charge of RM50 and overtime of RM200 he is still considered to be an employee within the definition of the EA because the First Schedule excludes overtime calculation from wages whereas section 2c excludes any travelling allowance from this equation. The hourly basic rate of pay is calculated as follows. This means an average of about 4 hours in 1 day.

However employers are also allowed to choose any other calculation basis which is more favourable to the employee eg monthly wages22 if the employee works 5 days a week. 60 of Malaysia Employment Act 1955. Do note that Employment Act only covers employee whose wages is less than RM2000.

Normal working day 15 Basic pay 26 days X 15 X hour of works. Working Overtime In Malaysia Here S What You Should Know By Legal Street Medium. Overtime work during normal day 15 x hourly rate pay overtime work 15 x RM480 RM720 LEGAL BACKGROUND In Malaysia matters concerning working hours and wages are regulated under the Employment Act 1955 and Minimum Wages Order 2016.

Of course overtime work has a limit. Calculation of overtime on Public holiday PH which is recognised by employer. Hourly basic rate of pay x 1 5 x number of hours worked overtime.

Every 5 consecutive hours followed by a rest period not less than 30 minutes. How OT hours are calculated based on Seksyen 60 3 Seksyen 60 1 Employment Act 1955. Overtime on Public Holidays.

Hourly basic rate of pay 15 number of hours worked overtime. If overtime exceeds normal hours then one will be paid at 3 times the hourly rate of pay. Overtime work performed on a rest day entitles an employee to be paid at a rate that is not less than two times the hourly rate of pay.

Working on Off-day 20 Basic pay 26 days X 20 X hour of works. Any hours exceeding normal working hours is paid at 3 times the hourly rate of pay. Calculation of overtime calculation of rate payable after normal working hours during a normal working day calculation for work done on a positive working attitude malaysian labour laws and industrial relation laws understanding of employment act 1955 handling misconduct.

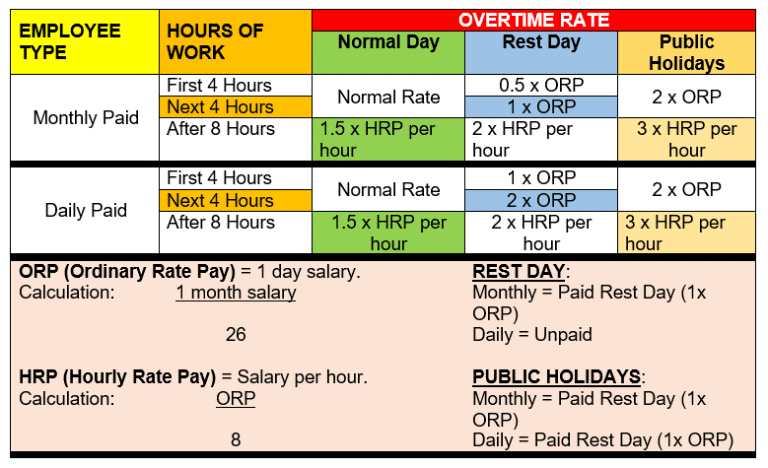

Overtime Rate according to Malaysian Employment Act 1955. There are laws governing the hours of overtime work for employees in Malaysia. Employment Act 1955 Salary Calculations And Benefits Marm.

Calculating Overtime According to Employment Act overtime on public holiday shall be paid in addition to the holiday pay which is 2 days wages at Ordinary Rate of Pay. Normal working hours 1. Working on Public Holiday.

The law on overtime For employees with salary not exceeding RM2000 a month or those falling within the First Schedule of Employment Act 1955 the laws in respect are spelled out in the Employment Act 1955. How overtime pay is calculated. ½ the ordinary rate of pay for work done on that day.

Hourly basic rate of pay 1 5 number of hours worked overtime rest day or public holiday pay rest day. 15x hourly rate of pay 2. Section 60A 3 of the Employment Act defines that overtime work means the number of working hours carried out in excess of the normal working hours per day as provided in the section 60A 1 of the Employment Act.

While a generalized overtime rate refers simply to those hours worked outside of the standard working schedule overtime calculator commonly refers concurrently to the employees remunerations of such work. The Employment Limitation of Overtime Work Regulations 1980 provides that the limit of overtime work shall be a total of 104 hours in any 1 month. For employees paid on a monthly basis overtime entitlements under the Employment Act are as follows.

In the case of an employee employed on piece rates who works on a rest day he shall be paid twice his ordinary rate per piece. Where work does not exceed half his normal hours of work. In addition to the PH pay employees get OT of 2 times the ORP for one day.

Overtime Calculator For Payroll Malaysia Smart Touch Technology. The Employment Act provides that the minimum daily rate of pay for overtime calculations should be. The employment act 1955 is the main legislation on labour matters in malaysia.

Overtime Working Hours. Working in excess of normal working hours on a normal work day. Overtime Work on Rest Day.

For staff members whose monthly salary is or to RM200000 and any increase of salary where the OT is capped at RM 200000 the Company pays the following overtime rate which is in accordance to the rate provided by the Malaysian Employment Act 1955 as follows-a. Rest day follow normal working hours.

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Overtime Calculator For Payroll Malaysia Smart Touch Technology

What You Need To Know About Payroll In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Posting Komentar untuk "Overtime Calculation Malaysia Employment Act"